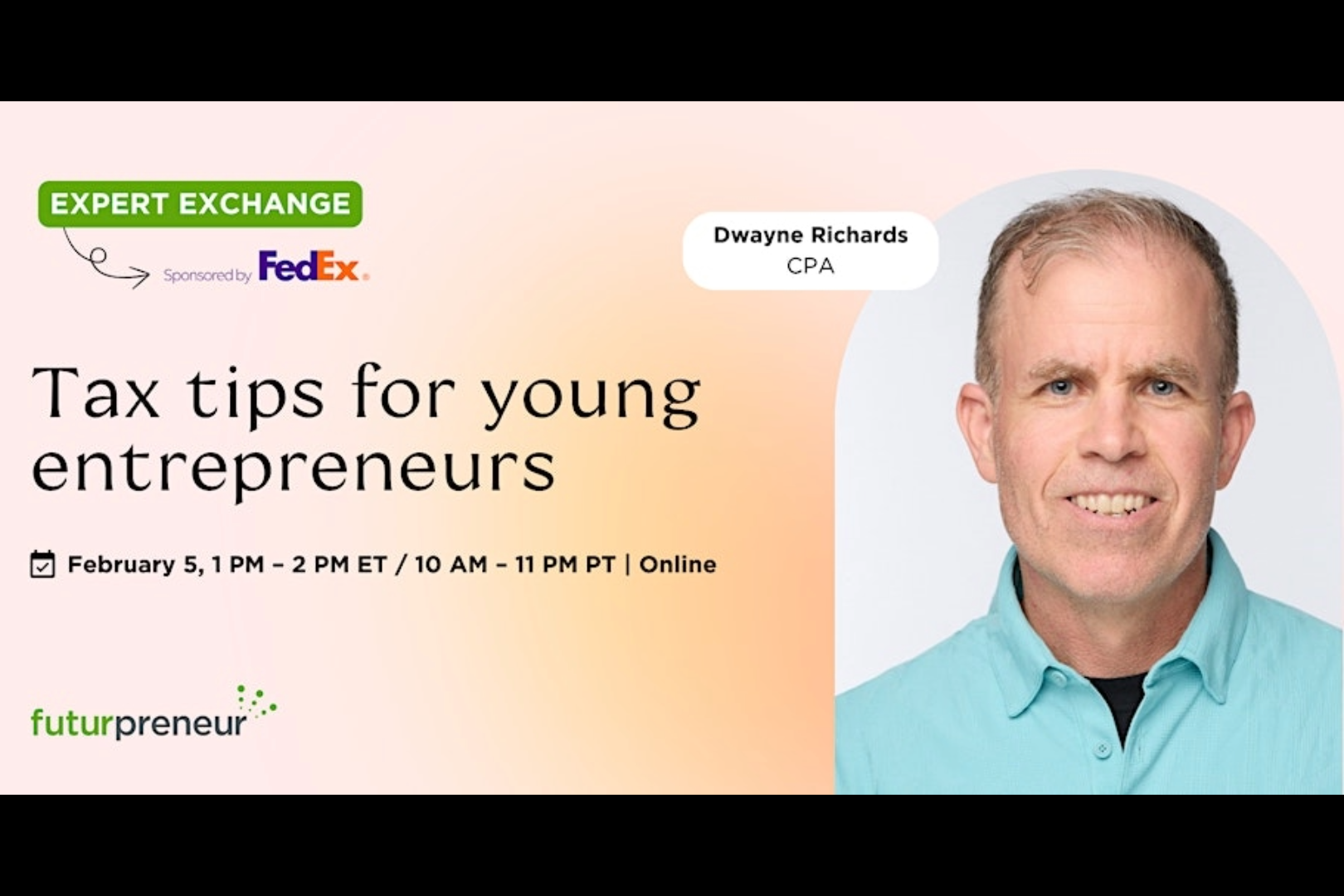

Hosted by Futurpreneur and facilitated by Dwayne Richards, CPA, this workshop provides essential tax insights for young entrepreneurs.

Join Futurpreneur for an engaging webinar designed to empower young entrepreneurs with essential tax knowledge. Led by Dwayne Richards, CPA, this session will provide practical insights to help you optimize your business finances, avoid common pitfalls, and plan for growth.

What You’ll Learn:

Understanding Taxes for Entrepreneurs: Learn the differences between personal and business taxes, GST/HST applications, payroll taxes, and corporate tax filing.

Avoiding Common Tax Mistakes: Discover how to track expenses properly, meet deadlines, and avoid paying yourself incorrectly.

Tax-Saving Strategies: Maximize deductions, leverage tax credits and incentives, and understand RRSPs and TFSAs.

Staying Compliant: Get tips on record-keeping, audit triggers, and when to seek professional help.

Planning for the Future: Prepare for business expansion and succession while staying tax-efficient.

Dwayne Richards, CPA, is is a seasoned accounting professional with over 10 years of experience helping entrepreneurs and small businesses navigate the complexities of the Canadian tax system. Specializing in tax planning, business structuring, and financial management, Dwayne has worked with a wide range of clients to optimize their tax strategies and ensure compliance with Canada Revenue Agency (CRA) regulations. His expertise and commitment to providing practical, actionable advice make him a trusted partner for young entrepreneurs looking to grow their businesses while minimizing tax liabilities.

Don’t miss this opportunity to enhance your tax knowledge and set your business up for success. Register now to secure your spot and take control of your financial future!

This event is hosted by Futurpreneur Canada.